Navigating Tax Season: Using SILOSS for IRS-accepted Receipt Storage

Tax season can be daunting for businesses, but with SILOSS, navigating this annual obligation becomes streamlined and efficient. SILOSS's robust platform offers IRS-accepted receipt storage, ensuring businesses are well-prepared for tax filing and compliance. This article explores how integrating SILOSS into your financial workflow can transform tax season from a stressful ordeal into a manageable process, highlighting the app's key features like budgeting, expense categorization, and audit trail.

-

Streamlined Receipt Capture and Storage

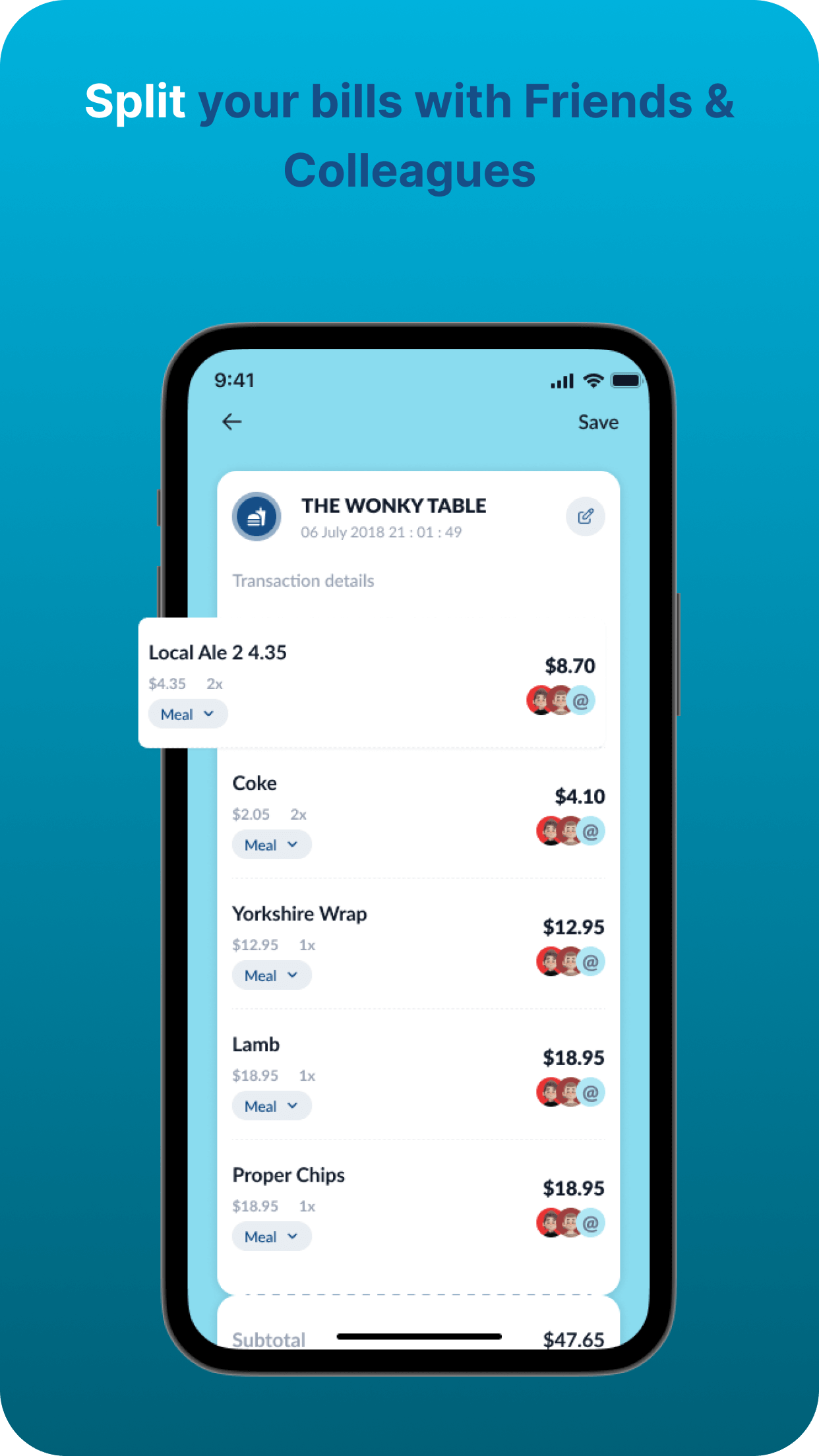

SILOSS simplifies receipt management with its advanced receipt capture feature, allowing businesses to store digital copies of receipts that are acceptable for IRS audits. This not only aids in effective cost control but also ensures that all financial transactions are well-documented and easily retrievable, supporting thorough spending analysis and fiscal responsibility.

-

Efficient Expense Categorization and Reimbursement

With SILOSS, expenses are automatically categorized, making it easier to track and report deductible expenses during tax season. This feature and a streamlined reimbursement process ensure that all financial activities are accurately recorded and aligned with tax regulations, enhancing tax compliance.

-

Robust Financial Planning and Analysis

SILOSS's financial planning tools and real-time analytics give businesses insights into forecasting financial trends and preparing for tax obligations. By monitoring cash flow and conducting regular account reconciliation, companies can maintain a steady financial course and avoid surprises during tax season.

-

Secure Audit Trail and Mileage Tracking

Maintaining a reliable audit trail is crucial for tax purposes, and SILOSS ensures that every financial transaction is logged and accessible. Additionally, the app's mileage tracking feature offers a precise record of travel expenses, which is essential for claiming tax deductions related to business travel.

-

Automated Expense Approval Workflow

The expense approval workflow in SILOSS is designed to comply with expense policies and ensure that all financial records meet IRS standards. This automation saves time and reinforces adherence to tax compliance requirements. In conclusion, SILOSS provides a comprehensive solution for businesses aiming to streamline their tax preparation process. By offering IRS-accepted receipt storage, along with features like budgeting, cash flow monitoring, and financial forecasting, SILOSS equips businesses with the tools necessary to navigate tax season confidently and efficiently. With SILOSS, tax compliance is no longer a challenge but an integral part of your business's financial success strategy.

See SILOSS in Action

Are you curious about how SILOSS can simplify your expense management? Sign up for a demo and experience its features firsthand.

Benefits of the Demo:

Personalized Walkthrough: Our team will guide you through SILOSS's features tailored to your needs.

Answers to Your Questions: Get answers to any questions about the app's capabilities.

Discover the Possibilities: Experience how SILOSS can transform your expense management.

Limited Availability: Demos are available on a first-come, first-served basis. Secure your spot now!