10 Key Benefits of Proper Expense Tracking for Small Businesses

Effective expense tracking is crucial for small businesses aiming to maintain financial health and operational efficiency. Utilizing tools like the Siloss app can significantly enhance this process, providing comprehensive solutions to common financial management challenges. Here's how proper expense tracking, facilitated by Siloss, delivers critical benefits to small businesses:

-

Budgeting

Accurate expense tracking lays the foundation for effective budgeting. Siloss helps businesses plan their financial activities and ensures that spending aligns with strategic goals, preventing over-expenditure and enabling sustainable growth.

-

Cost Control

With Siloss, small businesses gain insight into spending patterns, identifying areas where app users can reduce costs. This level of cost control is vital for maintaining profitability and competitive advantage.

-

Receipt Capture

Siloss simplifies receipt management through digital capture and storage, reducing paperwork and minimizing the risk of lost financial data. This feature supports efficient expense recording and processing.

-

Reimbursement

The app streamlines reimbursement, ensuring employees are compensated promptly for out-of-pocket expenses. This boosts morale and trust in the company's financial management.

-

Spending Analysis

Through detailed spending analysis, Siloss provides valuable insights into where money is going, helping businesses make informed decisions about financial strategies and resource allocation.

-

Account Reconciliation

Regular account reconciliation can be simplified with Siloss, which matches expenses against bank statements, ensuring accuracy in financial records and highlighting discrepancies for resolution.

-

Cash Flow Monitoring

Siloss offers real-time analytics for continuous cash flow monitoring, enabling businesses to effectively predict and manage financial ebbs and flows, thus avoiding potential liquidity issues.

-

Expense Categorization

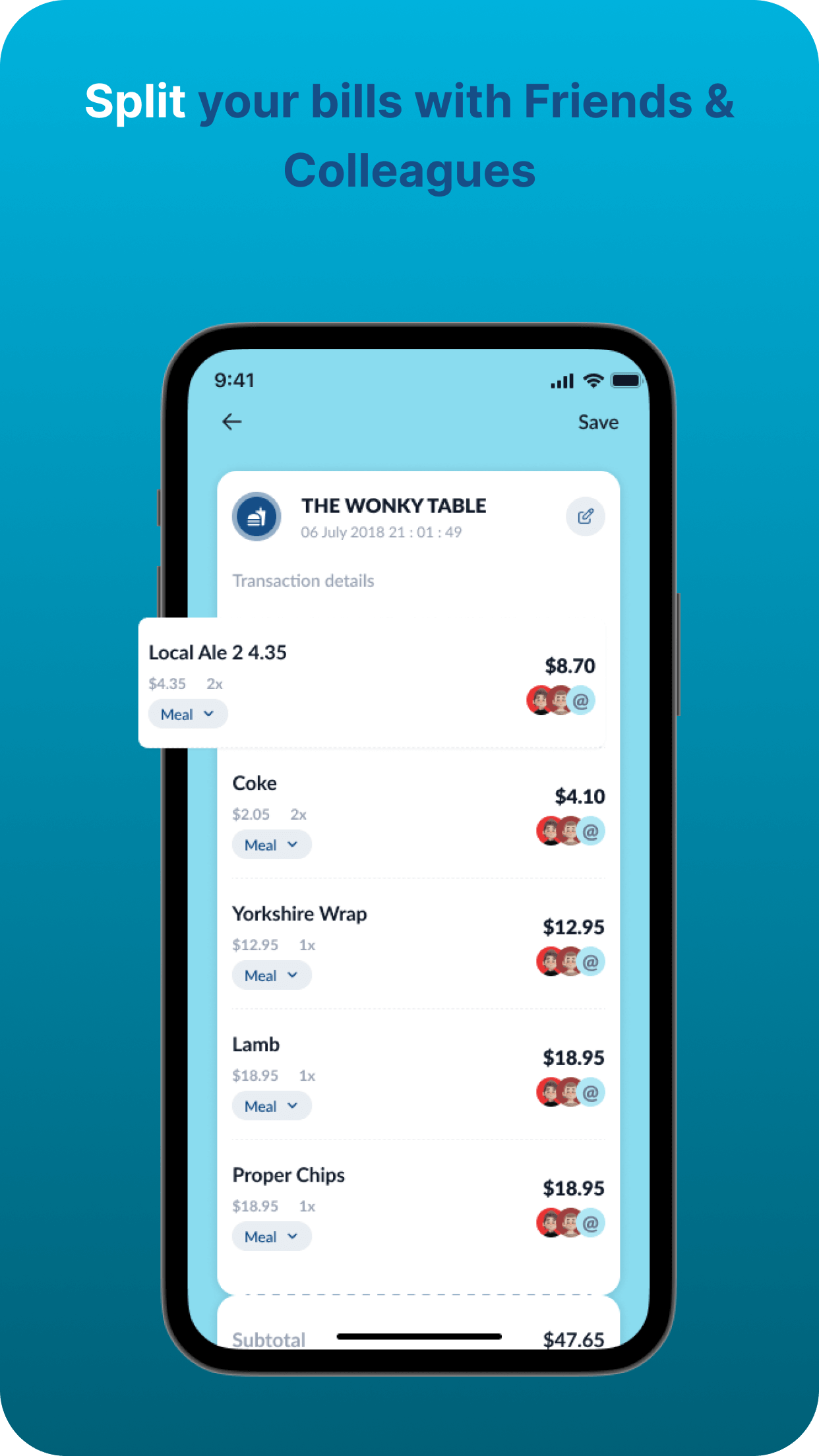

With Siloss, expenses are categorized automatically, making it easier to track and manage different types of spending, from operational costs to capital investments, enhancing fiscal responsibility.

-

Fiscal Responsibility

Siloss's comprehensive tools foster a culture of fiscal responsibility, ensuring that all financial activities are conducted with accuracy, efficiency, and compliance.

-

Tax Compliance

Silos aid in maintaining tax compliance by keeping accurate and detailed records of all transactions, simplifying the tax filing process, and reducing the risk of penalties or audits.

Additionally, features like mileage tracking and audit trail in Siloss ensure that businesses can keep accurate logs of travel expenses and maintain a transparent record of financial transactions, respectively. The app's financial planning tools and expense policy enforcement capabilities support strategic financial management and policy adherence. Moreover, the expense approval workflow feature stratifies the verification and approval of expenses, aligning with internal control principles.

In conclusion, Siloss addresses the critical problems associated with expense tracking and provides an integrated financial forecasting and planning platform. Its suite of features is designed to meet the multifaceted needs of small businesses, promoting efficiency, accuracy, and growth in today's dynamic market environment.

See SILOSS in Action

Are you curious about how SILOSS can simplify your expense management? Sign up for a demo and experience its features firsthand.

Benefits of the Demo:

Personalized Walkthrough: Our team will guide you through SILOSS's features tailored to your needs.

Answers to Your Questions: Get answers to any questions about the app's capabilities.

Discover the Possibilities: Experience how SILOSS can transform your expense management.

Limited Availability: Demos are available on a first-come, first-served basis. Secure your spot now!